THE BLOG

Nov

Oct

Feb

<36%: Do you want to remain in business? We offer a turnkey program that will enable you to start/continue offering <36% APR title loans while maintaining a 200%+ ROI on your portfolio.

These solutions for continuing to offer <36% APR collateralized loan products “work” in all states!

1 in 3 Californians Struggle!

Nearly 1 in 3 Californians have a subprime credit score or no credit score at all,6 meaning they likely struggle to access credit through a traditional bank or credit union. Here’s the New York Fed Study: Click

We have 2 Solutions to choose for all States:

Offer CPI: “Collateral Protection Insurance” coverage to your title loan/collateralized borrowers.

OR

Collaborate with a federally recognized Native American Indian tribe. LeaningRockFinance.com ] #consultingservices #ab539 #tribelending #smalldollarloans

California AB539: The law became effective January, 1st, 2020. California Department of Business Oversight Law: Click Here CDBO

Solutions for <36% APR Lenders

We’ve reviewed hundreds of existing California CFL consumer contracts. The majority already reference the forced-placement of collateral protection insurance to protect the lienholder from a catastrophic loss.

If your contracts do not already have this language, allow our 25-year experienced Team to provide your contract language free of charge.

Additionally, we offer a 100% turnkey package enabling your title loan company – in any State – to offer <36% APR collateralized loan products while still earning superior ROI on your business investment.

Simply email: TrihouseConsulting@gmail.com to schedule an exploration.

Native American Indian Tribe Collaborations

Additionally, if your offering consumer personal loans at ANY APR, we provide collaborations with Native American Indian tribes. This “works” just like the “bank model.” Visit LeaningRockFinance.com for an introduction.

Feb

Opening a car title loan business in Alabama is easy, and can be very profitable. Alabama has specific licensing, regulatory and compliance statutes in place. You can access all the Alabama car title loan, pawn, small-dollar loan and payday loan license applications here: Alabama Department of Financial Institutions.

FAQ’s [Alabama Frequently Asked Questions] for entrepreneurs interested in launching or buying a small-dollar loan company are available there as well. Regarding payday loans in Alabama, there is a statewide database.

Frequently Asked Questions: Statewide Database for Deferred Presentment Providers Updated February 15, 2019

Frequently Asked Questions: Statewide Database for Deferred Presentment Providers Updated February 15, 2019

If you have invested in our “bible:” How to Loan Money to the Masses Profitably, you know that we advise readers of our course to study our Course carefully and then actually get a loan yourself.

Here’s some interesting commentary from JD Supra regarding maintaining secured creditor rights in regards to Alabama car title loans & pawn.

Secured creditors must be ever mindful of their rights in consumer bankruptcy cases. Details that might seem technical or insignificant can mean the difference between a creditor’s obligation being secured and being unsecured, having a claim denied or having collateral released from the bankruptcy estate into the hands of the creditor, allowing the creditor to mitigate its financial loss.

In a recent case from the U.S. Bankruptcy Court for the Middle District of Alabama, a secured creditor was able to protect its interest in collateral in two bankruptcy cases where its title pawn transaction customers failed to redeem their pledged vehicles during the required time period. As a result, the secured creditor was able to obtain relief from the automatic stay and exercise rights against the collateral, resulting in a better financial result for the creditor.

As always, the technical details were important to the end result for the creditor. Donna Thompson and Kisha Daniel entered into title pawn transactions and several renewals with TitleMax of Alabama, Inc. Each customer provided TitleMax with the certificate of title to her vehicle, and those certificates of title identified TitleMax as the first and only lienholder.

Each customer then filed for protection under Chapter 13 of the U.S. Bankruptcy Code and declared her intention to repay TitleMax through her Chapter 13 plan. TitleMax objected to confirmation of both Chapter 13 plans and asked the court to grant it relief from the automatic stay with respect to both debtors’ vehicles, claiming that the vehicles were not the property of the debtors’ bankruptcy estates and were not subject to the automatic stay. TitleMax argued that the debtors failed to redeem their vehicles within the time period allowed under Alabama law and the Bankruptcy Code and that the court should grant TitleMax relief from the automatic stay with respect to both vehicles.

The debtors argued, among other things, that their transactions… the Pawnshop Act… Read more below,

Jan

LA’s billionaire king of subprime auto lending

Car title loan lenders get a bad rap from the majority of society because most people are unable to put themselves in their “brother’s shoes.”

Here is an example of a real-world car title loan lender who enables average folks who need a car in order to get to work, pick up their kids…

Setting the scene

Every weekday around 6 a.m. Don Hankey, 76, arrives by chauffeured car at his office near Hancock Park. Hankey started in the auto business nearly 50 years ago, when he took over his father’s car dealership at Vermont and Beverly. That business eventually grew into The Hankey Group, a collection of seven mostly car-related companies: Insurance, rentals, technology, but also real estate. The real moneymaker of the group, however, is Westlake Financial Services, a huge subprime auto lender that does business throughout the U.S., Mexico, India and the Philippines.

On a recent morning at 7 a.m., the company had already approved 286 deals. By the end of the day, Hankey said, he expected that number to hit 20,000. Interest rates for these loans can reach as high as 30% (versus the national average rate of about 4% on a 60-month loan). “We try not to say no,” said Hankey. “We just try to make it impossible to buy the deal,” either through high-interest rates or demanding more money down.

On accusations of predatory lending:

“Let’s say you have somebody with bad credit, so they either have to pay 18% interest or not get a car at all. Are we better off just not giving them a car? I think they need a car. Maybe it provides a job for them that they wouldn’t otherwise have. There’s good and there’s bad to it, but I think that I think the good [out]weighs the bad.”

On the origins of the subprime auto lending boom:

“You know, people say they’re going to pay their house payment first. And then a funny thing happened in 2008, 2009 [during the mortgage meltdown] … Many people let their house go, but they needed that car, and they couldn’t go to work without the car. They left their house…and kept their car payments current.”

That means Hankey, and other lenders can make money two ways: From their borrowers paying back those high-interest loans, and by selling those loans off to Wall Street, where demand increased post-recession.

“People buy that credit. They were very concerned during the Great Recession that these things would default. But what happened is that almost all of them got paid in full, and you saw the defaults on real estate. People go out of their way to hold onto their car in a bad period of time.”

As long as people need cars to get to work, Hankey says, he’s not worried about a massive wave of defaults like what happened in the housing market a decade ago.

Originally Posted here: “Subprime Auto Lending.”

Jan

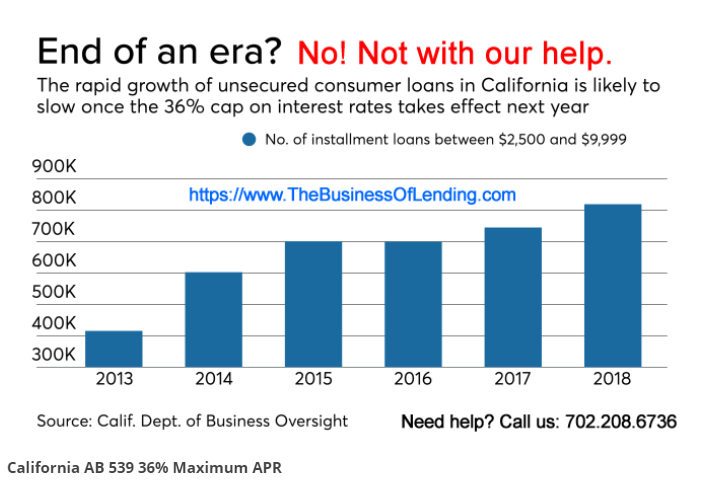

AB539-California 36% APR Rate Cap: Devastation + Disruption = Opportunity for CFL Lenders

By: Jer Ayles. Are you a California Lender operating per the CFL licensing model? Ready to throw in the towel, sell off your portfolio, collaborate with a federally recognized Native American Indian tribe, layoff your employees, tell the average Joe’s and Jills you simply can no longer serve them when they face a sudden financial emergency… Are you going to give up the business of lending money to the masses?

WHAT: California AB539 bans loans between $2500 and $10,000 with APR’s exceeding 36%. It became effective January 1st, 2020. This is huge. But, there are two fixes for this IF you choose to start or continue to loan money to the nearly 50% of Californians unable to access $400 cash in an emergency!

WHY: A $100 loan for 12 months yields the Lender $36.00 PER YEAR! Lenders cannot pay to acquire customers, pay their rent, pay their employees, process loan applications, spend capital on radio, TV, direct marketing, Google, Facebook, Instagram… process the loan applications [production costs] they secure via all these efforts… And then attempt to collect their hard-earned money by reaching out to customers by phone, text, letters…

RESULT: California loans of less than $4,000 = $5,000+ WILL NO LONGER BE OFFERED to consumers with “shitty credit.”

That’s life!

Consumers with poor credit, thin files, maxed credit cards, friends and families in the same boat, communities of color, low wage earners, Latino owned businesses, even the President of the NAACP said his constituents… “cannot qualify for a short term small-dollar loan ANYWHERE in California!” [Except perhaps from an illegal, unlicensed loan shark, by pawning the stuff in your garage, knock you over the head while you dodge the needles and excrement in the streets of your city, outrun the tent cites along your bicycle trails…

BANKS and CREDIT UNIONS [CU’s do are non-profits and do not pay taxes by the way] DO NOT WANT TO SERVE THESE BORROWERS! “It’s expensive, a hassle, and they do not pay back their loans in a timely fashion,” said a banker at Lend360!

Where are these ordinary Americans supposed to get their hands on $400 FAST to keep on the lights, pay for their kid’s prescription, fix the car so they can participate in the gig economy, or serve you your Big Mac?

READ ON! This may be a long read BUT it will save your business, your investment, your employees, your customers, your landlord, and your life’s work and contribute to the tax base enabling our elected officials to continue to abuse all Americans!!

Are you aware that the “big boys” sponsored AB539? They spent huge sums of $$$ on PACs and politicians in California to make certain all of us “little guys” cannot compete? Do you know that this 36% APR cap calculation does not include ancillary fees such as non-refundable loan origination fees, credit insurance [that only subsidizes the Lender and consumers must pay again each time their loan is renewed], club memberships, life insurance, accident, health, and disability insurance, involuntary unemployment insurance, property insurance, “nonfiling” fees, accidental death & dismemberment insurance, automobile security plans… MY Point? THE ALL IN APR – annual percentage rate – our sub-prime borrowers pay is HIGHER than the stated APR on their loan contract.

Guess who just a few of these “Big Boys” are:

- Lendmark Financial Services

- OneMain Financial

- Oportun

- Why? They implement a “loan packing” strategy. They add on all the “ancillary” products I mention here; none of which benefit the borrower!

Example? “Credit insurance premiums” are paid ALL UPFRONT! Credit insurance increases the cost of consumer borrowing by 33% while providing ZIP benefits for consumers. And again, these fees are NOT included in APR calculations!

THE REAL WORLD: A stated APR for a nine-month loan, $511 is 43% but the “ALL-IN APR” is 138%! Why? How? Because the so-called “big boy” PAC & politician enabled installment lender charges “credit insurance” with this loan and finances the lump-sum premium payment – $203. Thus, the amount financed increases from $511 to $714 and results in a 138% APR!

Do you know 10M+ US residents take out loans ranging from $100 – $10,000 and pay more than $10 Billion dollars in fees?

Do you know that banks and credit unions make the majority of their profits on NSF fees? They hate small-dollar lenders; unless of course they can provide $300M credit lines to the very lenders who sponsored AB539!

It’s CRIMINAL!

Smaller loans <$2500 MUST HAVE higher APR’s The operating costs for a Lender serving the sub-prime are simply TOO high. The fixed costs for a $500 loan are the same as for a $2500 loan! Upfront and customer acquisition costs are a much smaller share of the revenue from a $2500 loan vs a $500 loan.

California AB539: 36% APR Rate Cap = Devastation = Disruption = Opportunity

By now, the thousands of you who follow my rantings know that the Calif. Department of Business Oversight has begun enforcing the 36% APR rate cap [AB-539] on consumer loans between $2500 > $10,000. This bill impacts both title loans and personal, noncollateralized loans.

What’s this mean? 70% – 80%+ of the Lenders serving California consumers today will STOP funding these loans. 20 million consumers facing temporary financial hardships will have nowhere to turn to for a no-hassle, small-dollar loan FAST! 70% to 80%+ of California Lenders are shutting their doors, laying off their employees, shunning their landlord, not paying taxes… and wishing their thin-file, no file gig economy customers “SO LONG!”

DEVASTATION

Jorge Jones has a landscaping job in Los Angeles. His wife Francis works at a restaurant. Auntie, who lives 14 miles [a rent-controlled one-bedroom apt.] and 4 bus routes away, takes care of the Jones’ two kids.

Jorge’s 12-year-old Toyota pickup needs engine work. The bank turned Jorge down for a loan. Jorge’s credit card is maxed. He’s already borrowed from friends and family in the past; owes them money.

Mary, single with a 3-year old daughter, works for 2nd Chance Community Loans, a chain of 15 small-dollar loan stores in So. Calif. She knows the 1st names of all her customers, their kids’ names, their family situation… Her customers borrow money a few times per year when the washing machine breaks down, the oven takes a dive, the family car needs work…

They all live paycheck to paycheck; virtually no savings in spite of having tried. Life happens…

Carlos owns 3 strip malls. One each in Garden Grove, Santa Ana & Costa Mesa. He’s 55 years old. Worked his ass off as a carpenter, saved money, read real estate books, invested with a buddy in a run-down strip mall, refurbished it and eventually added two more. Each strip mall has the usual mix of Circle-K, a couple of restaurants, dry cleaner, a 2nd Chance Community Loan franchise…

Carlos just received “The Letter.” 2nd Chance community Loans is pulling out of California…

The Costs for Producing a 36% APR Loan

So what you say, dear reader? A $2500 loan at 36% interest is ridiculous anyway! “Good riddance to these loan sharks!”

OPPORTUNITY

My Team has invested hundreds of man-hours researching, talking and meeting with savants in “the business of lending money to the masses.” It’s been a whirlwind of action and creativity. The results? Success.

We have solutions [ancillary products, tribal collaborations, automation and fraud reduction strategies, lower CAC and FTPD metrics… for you that offer safe and profitable solutions for you to continue to serve your California communities with emergency funds! Reach out to TrihouseConsulting@gmail.com ASAP for details. We’ve invested the past 6 months evaluating and preparing for January 1st and AB539! We have assembled a Team…

Email Jer at TrihouseConsulting@gmail.com! Include details! Are you a CFL? What type[s] of loan products do you offer? Are you a storefront or internet Lender? Ballpark, how many loans/month? Average term? Avg. loan principal. Installment? Balloon? Additional “color” will move you to the front of the line… We’ll send you an MNDA and share the solutions available for your specific situation!

[Again: want to explore the tribe sovereign nation model? Click Here: https://LeaningRockFinance.com DISCREET is the word.]

PS: If you plan to simply “throw in the towel, to give up… let us know! We are buyers! We are happy to take your California Market share and SCALE big time. The regulators and paid-off politicians can make the business of lending to the masses more difficult BUT they cannot regulate DEMAND away. Demand for loans by credit-challenged consumers is going nowhere but UP! We want your data, your portfolios, your IP, your websites..!

You too can “play” like the big boys! It just takes creativity, iteration, knowledge, and a little help!

Collateralized [Title] Lenders: Don’t abandon California consumers and your employees in need of your help! If you’re a title loan lender, you can remain in business by submitting to this crazy 36% APR while offering “Lender Collateral Protection” to your customers in dire need of your help while still earning a very respectable ROI. And, since the majority of your competitors are not reading this, YOU CAN EASILY SCALE and TAKE MARKET SHARE! A 25-year-old, Triple A-rated insurance company executive Team has a complete turn-key solution ready for you to implement in <30 days! Your out of pocket start-up costs to get up and running? MINIMAL!

Non-Collateralized [Personal Loan/Installment] Lenders: I have another proven strategy for you as well.

Dec

Want to start a car title loan business? Here are a few tips.

- Visit a car title loan company and get a title loan! Yes, step one is to actually go through the loan process as a real car title loan customer would. The best way to learn the “behind the scenes” process is to get in your car and go get a title loan. Borrow the minimum amount your future competitor will loan you on your car title.

- 3 to 4 days later, go back into the car title loan store and pay off this loan. Again, go through the process.

- Depending on your state, these steps will likely cost you $200 – $400. The information you gain by actually going through the car title loan procedures and the process is invaluable. Consider these fees the cost of your education.

- Get copies of EVERYTHING during the loan process. Take notes the moment you leave the car title loan store. Take pictures with your phone. Take pictures of the disclosures on the walls, the interior, and exterior signage, the point-of-sale materials… EVERYTHING possible.

- Be smart. First, just visit several stores. Inquire about their car title loan product. Ask the customer service representative (CSR) about their requirements. If you luck out, you may even be able to engage the CSR in lengthy conversations about the business! Talk it up!

- Eventually, you’ll need the following documents to actually get a loan from your “target” future title loan competitor.

- Valid identification/driver’s license

- Your vehicle/car

- Your title to this car – lien-free

- You’ll likely be offered 45% of the “rough value” indicated at https://www.nadaguides.com/

- Proof of residency. Bring a utility bill, lease, rent statement.

- Proof of your last payday. Check stub, bank statement…

- Miliary exemption? The car title lender will run a check on you.

- Vehicle Evaluation Checklist: The car title lender will review the condition of the car you are offering them for your “research project” car.

That’s all. Now, go back to your office, Starbucks… and write down ALL your observations. How were you greeted? Treated? What was the process? document everything!

Again, three or 4 days later, go back to this car title loan lender and pay off your title loan. Once more, DOCUMENT EVERYTHING! Get copies of EVERYTHING.

Lastly, get our bible: “How to Lend Money to the Masses.” In it, we thoroughly discuss the strategies and tactics, licensing, marketing, websites, store & online lending model… CLICK HERE for the ‘Table of Contents.”

May

We lenders are a creative bunch! State or FED mandated 36% APR maximum?

I now introduce Finova Financial – online vehicle title loans – as a case study in advertising sub-36% APR’s while achieving a nearly 200% APR.

I toss this out to help you and your Team get your creative juices flowing. A little inspiration…

PS: I’m not a lawyer! Don’t make these loans without competent legal advice! AND, this piece is long. If you prefer mickey mouse “Click Bait” content visit Buzzfeed.com

Finova is a 100% online, mobile, anywhere 24/7loan platform advertising a line-of-credit loan product collateralized by the title to a car. “Complete the loan process online, instant approval, with same day cash funding.” In reality, the borrower receives a lump sum when the loan is approved. Roughly 2,000,000 title loans were funded last year in the USA; obviously not all by Finova. Finova is operating in 7 states last time I counted.

The typical Finova title loans are amortized over 12 months; no balloon at the end. The loan transaction does NOT require any face-to-face interaction. Hint: borrowers who lack bank accounts make their monthly payments via MoneyGram’s 30,000+ locations [MoneyGram fee is $11.00 each] or by credit and debit cards.

To be crystal clear how these vehicle title loans work, here’s a testimonial posted by a happy Finova Financial client taken from their website:

Finova had the whole “take a picture and text it” text message. I clicked on it which made it easier to be able to upload everything. Everything was done electronically and I didn’t have to go to a location. I had to mail off my title but other than that I didn’t have to go into an office and sit down with anybody. [Full testimonial below.]

According to Finova’s last “Pitch Deck:”

- Their average loan size is $1,665.

- Life of Loan is 12 months.

- Target revenue is $3,060.

- They have a 10% retention rate at maturity.

- Estimated Customer Lifetime Value [CLTV] $3,366.

- Client Acquisition Cost [CAQ] $88.

- CLTV/CAC = 38X

- Avg. 1st customer payment $298.

- Clients have returned up to 5 times for new loans.

- 15% of the portfolio has had multiple Finova loans.

- Avg. Loan to Value [LTV] 30% of retail value

- <50% of Blackbook Rough Wholesale value.

- <10% default rate.

The vehicle title loan funds are credited to the borrower via ACH, retrieved at MoneyGram or in the ideal Finova scenario, to the privately branded Finova Secured Debit Card.

According to publicly available info posted on Nerd Wallet, [As I understand it, NerdWallet Co-Founder Jake Gibson participated in one of the capital raise rounds for Finova Financial] “a typical Finova Financial customer borrows $1,700 and qualifies for an APR of 22.5%. Finova’s stated APR ranges from 17% to 30%, but adding fees and the cost of insurance for a $1,700 loan, the effective APR is actually 187%.”

So, how does Finova Financial achieve these >36% APR’s?

And how is it that Finova can participate in the Google Adwords program? How can Finova Financial be compliant with Google’s loan advertisement policies?

Let’s count the ways…

A 36% APR? Don’t ASSume that means you can only charge your borrower $360 per year for a $1000 loan!

Know this about APR’s: The Annualized Percentage Rate is defined as the annualized finance charges expressed as a percentage of the amount financed. This rate has to be disclosed in the contract under the TILA. The stated APR includes certain fees, such as origination, that the interest rate does not; both exclude costs for ancillary products.

Example?

Finova Financial offers a Car Equity Line of Credit (CLOC) via a cloud-based, digitally delivered loan – No Brick and Mortar locations – based on car equity and the “Finova Automobile Secured Prepaid Card,” which accepts either cash or car equity to fund the card.

This group is SMART!

Here’s what one customer wrote about them on their website:

“Finova had the whole “take a picture and text it” text message. I clicked on it which made it easier to be able to upload everything. Everything was done electronically and I didn’t have to go to a location. I had to mail off my title but other than that I didn’t have to go into an office and sit down with anybody. I had a digital title which was a pain in the butt but Finova was awesome with their help. I dealt with two different people because I called when one had already gone home. They picked up seemingly with no problem, so it made me feel good that they work so close together that if someone wasn’t home, the process doesn’t stop.”

“Also, I enjoy the fact that I got the reminder text because it helped me make my first payment. Everything was good to go and I was able to make my payment on time. Plus the ease of being able to make a payment is spectacular. You just go right to Walmart or wherever you want and make that payment with no problem.”

Finova Financial advertises <36% APR loans. Google accepts their advertising! So how does Finova achieve 100%+ APR’s?

Again, according to Nerd Wallet:

Finova funds a client $1,700. The average borrower qualifies for an APR of 22.55 [This depends on where the borrower resides.] Finova’s stated APR ranges from 17% to 30%, but adding fees and the cost of insurance for a $1,700 loan, the effective APR is actually 187%.

Here’s a breakdown of the costs associated with Finova loans:

- Extra fees: Not all fees are included in the APR you receive. On top of the rate you qualify for, you’ll have to pay a $25 “credit investigation” fee.

- Insurance costs: Finova requires borrowers prepay for 12 months of comprehensive and collision insurance or buy an optional form of insurance from the company, known as a “DCC – debt cancellation addendum.”

- Finova requires that their borrower provide Finova with proof of comprehensive and collision insurance on the vehicle, with a deductible of $500 or less, through a properly licensed insurer. Such insurance must be reasonably acceptable to Finova, name Finova as loss payee, and show proof the policy is paid through the maturity date of the loan. In the event that you do not provide adequate proof of such insurance, you must obtain Finova’s Voluntary Debt Cancellation Addendum.

Finova’s customers are typically sub-prime vehicle title loan borrowers. They don’t have the CASH to pay up front to an insurance company for a $500 comprehensive and collision insurance policy. So… MANY Finova Financial vehicle title loan borrowers ELECT to purchase DCC coverage.

What’s that you ask? What is a Debt Cancellation Contract (DCC)

According to Investopedia:

A debt cancellation contract (DCC) is contractual arrangement modifying loan terms. Under the debt cancellation contract, the Lender agrees to cancel all or part of a customer’s obligation to repay a loan or credit. These contracts become effective upon the occurrence of a specified event as written into the contract. A debt cancellation contract (DCC) provides for the cancellation or suspension of loan payments when it becomes difficult, or impossible, for the borrower to make payments. These events may include an accident or the loss of life, health, or loss of income. Other reasons for debt cancellation include military service, marriage, and divorce. This product is also known as a debt suspension agreement (DSA)

DCC’s do not sell through insurance agents, brokers, or other intermediaries. They are a feature of the extension of credit, provided by the Lender.

DCC terms and costs are designed by the Lender.

DCC’s supposedly increase borrower “loyalty and satisfaction.”

DCC’s offer fee income potential for the Lender

There are NO licensing restrictions for selling DCC’s.

The Lender determines the borrower’s price for the DCC.

Here’s a link to a typical DCC provider: https://www.avpadmin.com/lenders/

Now, we all know that consumers are not nearly as dumb as the folks in D.C think they are. Our customers are simply budget constrained; big time! Several focus groups have revealed that a surprisingly large percentage of consumers know the difference between stated and all-in APR’s. “There’s a big difference between the [stated] percentage rate and what you’re really being charged.”

Pew has some interesting revelations and stats here: PEW

From PEW:

As an example, a stated APR for a nine-month, $511 loan issued in Kentucky was 43 percent, but the all-in APR was 138 percent.”

Because the lender sold credit insurance with the loan and financed the $203 lump-sum premium, the amount financed increased from $511 to $714, which resulted in higher interest and other charges.

When all the fees and insurance premiums were included, the all-in APR was 138 percent, three times more than the stated APR.

Depending on the state, Lenders are typically allowed to sell the following types of “insurance:”

- Life: repays a loan’s outstanding balance to the lender if the borrower dies. The payout decreases the longer the loan is outstanding because the policy covers only the remaining loan balance.

- Accident and health or disability: Makes the monthly payments to the lender if the borrower becomes disabled during the loan term, continuing until the borrower recovers from the health issue or the loan term ends, unless other policy restrictions apply or limit coverage.

- Involuntary unemployment: Makes required monthly payments to the lender if the borrower loses his or her job during the loan term until the customer finds new employment.

- Property: Covers the value of property pledged to secure a loan if a lender is unable to repossess the property for any reason.

- Nonfiling: Protects lenders against losses up to the value of the collateral in the event a borrower defaults and the lender did not undertake the time and expense to file the paperwork to register a security interest in the property.

- Installment lenders also are often allowed to sell accidental death and dismemberment insurance that makes loan payments if a qualifying event occurs.

- Lenders can also sell auto club memberships and automobile security plans.

WTF? Blockchain next for Finova Financial?

That’s another Post. Read about Finova’s plans for raising capital via Blockchain here: Finova Financial & Blockchain.

Apr

If you’re a title loan lender, read on. If not, DELETE NOW.

We offer car title loans in more than a few states.

In Los Angeles, we charge 8% to as much as 18% per month on the loan principal. Depends… Heavy competition!

In Texas, it’s closer to $25/per $100 borrowed.

Every state is different.

Pretty good ROI when everything goes as we planned, right?

We ultimately repo roughly 7% and sell them in order to recover our loan principal.

Sometimes we conduct private sales. Other times, we just run them through the local auction.

Among others, we use CarGurus.com… to list cars for sale.

Lately, our CSR’s are getting calls and texts from people who claim to be interested in buying our car – but first want to see a car history report.

They request we get this “car report” from a specific website.

This website requires some info AND pay $20 by credit card for the “report.”

We empower our CSR’s with a LOT of decision making! One of our CSR’s sent this “report” to the supposed buyer but never heard back.

Weird, huh?

Well, it gets weirder.

The FTC put out the following PR piece about this very thing recently. My Team and I missed it!

This happened to us! Don’t let it happen to your car title loan business.

Here’s what the FTC suggested:

It turns out that when car sellers go to one of these websites, they’re automatically redirected to sites ending in ‘.vin’

Seems like it might be related to your car’s vehicle identification number or VIN, right?

Scammers hope you’ll think that too.

In this case, .vin is a relatively new website “domain” – like .com or .org – that groups can apply to use.

This domain was intended to be used for sites that relate to wine, since “vin” is the French word for wine, but others are not prevented from using it.

So yes, that’s a clever take on .vin for cars, yes, but you still might want to think twice if anyone asks you to do car-related business on a site ending in .vin.

So, if you are selling a car online and someone asks you to get a car history report from a specific site, ask why and think twice.

You may have no way of knowing who operates the site, especially if it’s one you’ve never heard of.

It might be a ruse to get your personal information, including your credit card account number.

It also could be a way for “lead generators” to get information, which they sell to third parties for advertising and marketing purposes.

Your best bet: play it safe.

Go to ftc.gov/usedcars for information on vehicle history reports, recall notices, and how to learn whether a car has been declared salvage.

For example, the National Motor Vehicle Title Information System (NMVTIS) operates vehiclehistory.gov, which lists NMVTIS-approved providers of vehicle history reports. Not all vehicle history reports are available through the NMVTIS website.

Reports from other providers sometimes have additional information, like accident and repair history. Whether you’re familiar with a company or not, it’s always helpful to see what other people are saying online. Simply enter the name of the company, and words like “complaint,” “review,” “rating,” or “scam.”

Meanwhile, go make SOME SERIOUS $$$ in the car title loan business!

Starting a Title Loan Biz? Go here: https://www.AutomobilePawn.com

Jer – Trihouse 702-208-6736 Cell

Knowledge Store: Resources for Lending $$ to the Masses!

https://www.PaydayLoanIndustryBlog.com

Feb

What is your take on the bill introduced reducing the interest rate to 36% APR? Thanks, Roger P.

Great question.

I don’t “worry” about it. I’ve been lending since 1998; Garden Grove, Calif. was our 1st location.

New legislation introduced/defeated/passed… is part of the business of lending.

There are simply too many creative lenders, a daily improvement in tech, fraud prevention, a downward cost trend on loan underwriting, improved collection tools… and unquenchable consumer demand for loan products to ever kill “the business of lending money to the masses.”

36% APR? Who cares. Look at this lender to the military for just one example: OmniMilitary Loans. They advertise loans up to 35.99% APR.

Dig through all the fees. They often exceed 200%. Admin fee, debit card funding fee, they encourage “renew loans” after 4 payments, payments made via allotments… These folks have nowhere to go when faced with a financial challenge! “Thin-file; No-file; build credit; basic 101 tools…” I’M NOT PICKING ON THIS TEAM! They are offering a service that appeals to a huge demographic. A demographic who VOTES by choosing OmniMilitary to solve their financial challenge.

Look! It sucks when you’re in a financial bind. I’ve been there. That’s how I learned about the payday loan industry. But when the car needs fixing, the reconnection fee for keeping on the lights, the money for rent/food/prescription… you name it, runs out, who you gonna call? Your local “consumer advocate?” Your

Lacking multiple financial choices forces consumers facing credit challenges into using bank and credit card NSF/Overdraft fees to deal with emergencies. These “products” approach 1800% APR’s! AND, the banks and credit unions incur virtually ZERO risks! They get access to the borrowers’ bank account before ANY other lender! So-called “consumer advocates” refer to “alternative lenders” as “loan sharks? Man, look in the mirror, Bankers! Alternative financial lenders deposit cash into a borrower’s bank account and then literally pray they get paid back! This is simply not the case with bank products.

From BankRate.com: “While banks were technically earning a bit less from overdraft fees in 2017 than they were the previous year, they remain a key source of revenue for many banks. And despite political pressure, overdrafts fees are unlikely to fall significantly in the coming years. “

I’m not going to preach to the choir! I’m ASSuming you are a member!

SUGGEST YOU READ: “Debt: the First 5000 Years” and “The Ascent of Money” for perspective.

Jer – Team Trihouse702-208-6736 AND yes, I am biased. I admit it.